Imagine this: You’re walking across your living room floor, and it feels… spongy. You investigate further, and to your horror, you realize the floor is sagging. You pull up the carpet, and there it is – the source of the problem: rotten floor joists. The realization hits like a ton of bricks: you’ve got a serious, costly repair on your hands. So, the question arises – will your homeowners insurance cover the damage?

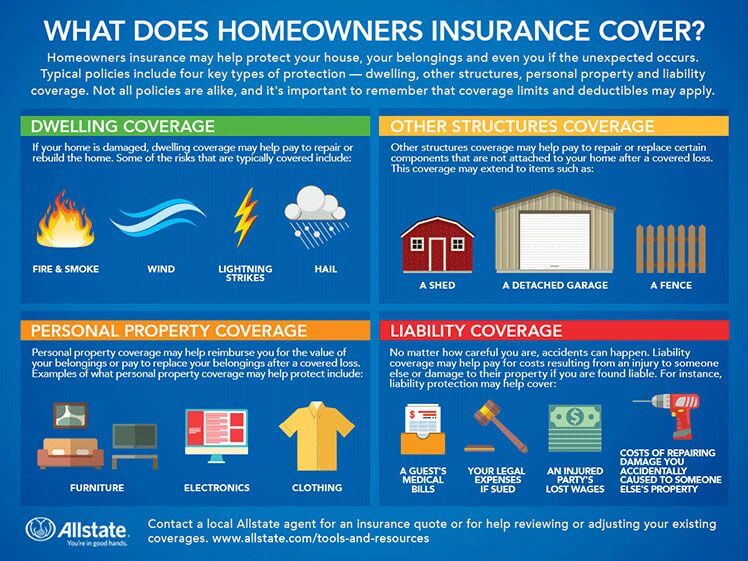

Image: www.allstate.com

The answer, unfortunately, isn’t a simple yes or no. It depends on several factors, and understanding these details can save you a lot of headaches and financial strain down the line. This article will delve into the murky world of homeowners insurance and rotted floor joists, helping you navigate this tricky situation with confidence and clarity.

Understanding Your Policy

The first step in determining if your insurance will cover rotted floor joists is meticulously reviewing your policy. The key to understanding your coverage lies within the fine print of your policy. It’s vital to identify the specific perils covered– events or situations your insurance will cover. Often, policies will spell out the exclusions – situations specifically not covered.

One crucial point to recognize is that homeowners insurance typically covers “sudden and accidental” events. This means that insurance is generally not intended to cover gradual deterioration or neglect. If your floor joists rotted due to prolonged water damage caused by a leaky roof or an overflowing bathtub, your insurance might cover the repair. They may even be willing to cover the cost of the rotted joists themselves.

However, if the rot is due to poor maintenance, neglect, or lack of proper ventilation, insurance might not cover the repair costs. Imagine that your home’s basement remains damp due to a lack of proper moisture control, leading to wood rot in the floor joists. This situation is more likely to be classified as “neglect” and may not be covered.

Common Causes of Floor Joist Rot

To understand when your insurance might cover rotted floor joists, it’s helpful to grasp the common causes of this problem.

- Water damage: Leaking pipes, overflowing appliances, and even excessive condensation can be major culprits.

- Termites: These destructive pests can feast on wood, leading to weakening and eventual rot.

- Fungal growth: Mold and mildew thrive in damp environments and can erode wood, contributing to rot.

- Lack of ventilation: Insufficient air circulation can create a breeding ground for moisture, promoting rot.

- Poor construction: Improperly installed or poorly sealed floor joists are more susceptible to moisture damage and rot.

The Role of Your Insurance Company

No matter how meticulously you read your policy, there’s a good chance you’ll have a few questions. Even if you’re confident about your coverage, talking to your insurance agent is crucial. This professional can provide valuable insights based on your specific policy and situation. They’ll be able to clarify the details of your coverage, explain potential exemptions, and guide you through the filing process.

Don’t be afraid to ask questions. Be prepared to show documentation and provide photos of the damaged floor joists. The more information you offer, the better equipped they’ll be to assess your situation and determine the extent of your coverage.

Image: www.youtube.com

Taking Action

If you discover rotted floor joists, it’s essential to take immediate action to prevent further damage. Here are some crucial steps:

- Identify the source: Pinpoint the cause of the moisture damage to prevent it from occurring again.

- Address the source: Repair leaks, upgrade plumbing, or improve ventilation to tackle the root cause.

- Contact your insurance company: Promptly inform them of the damage, even if you’re unsure about coverage.

- Get an expert assessment: A qualified contractor can assess the extent of the damage and provide detailed estimates for repair or replacement.

Does Homeowners Insurance Cover Rotten Floor Joists

Protecting Your Home and Your Finances

The discovery of rotted floor joists can be a daunting experience, but remember, you’re not alone. By understanding your insurance policy, identifying the cause of the damage, and taking swift action, you can minimize the financial impact and protect your home. Open communication with your insurance company is key to navigating this process effectively. Don’t hesitate to seek expert advice, and stay proactive in preserving your home’s integrity.