Imagine this: You’re a bustling entrepreneur, your business is booming, and you’ve got a team of dedicated employees. But as your company grows, you realize that managing payroll and expenses is becoming a tangled web. Suddenly, deadlines loom, mistakes happen, and the stress starts to pile on. You wish there was a clear, organized way to keep track of everything – a financial lifeline to guide you through the chaos. That’s where the payroll and disbursement journal steps in.

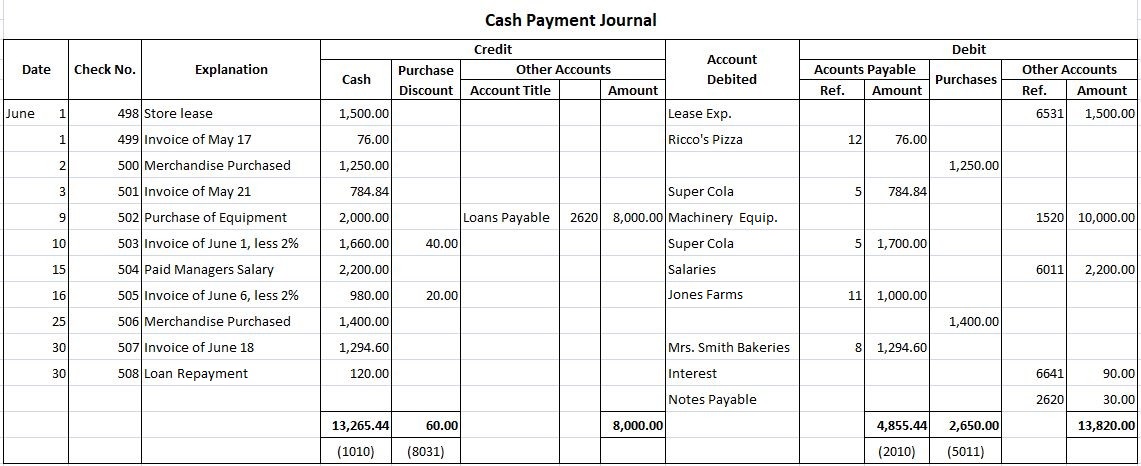

Image: www.vrogue.co

This simple but powerful tool is the backbone of efficient financial management, particularly for businesses. It’s a detailed record of all salaries paid, employee deductions, and any other financial disbursements made. Think of it as a comprehensive financial diary, recording every transaction related to your payroll and expenses, ensuring transparency and accountability in your business operations.

Unraveling the Payroll and Disbursement Journal: A Comprehensive Guide

The journal’s significance lies in its ability to provide a clear picture of your company’s financial health. It’s not just a collection of numbers but a meticulously organized system that reveals vital financial insights. Let’s dive deeper into its structure and its key benefits.

The Structure of the Payroll and Disbursement Journal:

The journal typically follows a structured format, encompassing various columns that capture critical details of every transaction. Here’s a breakdown of the essential elements:

- Date: This column records the date of each payroll run or disbursement.

- Employee Name/Payee: This column lists the name of the employee receiving a salary or the payee receiving a disbursement.

- Gross Pay/Disbursement Amount: This column captures the total amount before any deductions or payments.

- Deductions/Withholdings: This column details all relevant deductions, including taxes, insurance premiums, and employee contributions.

- Net Pay: This column displays the final amount paid to the employee after all deductions.

- Payment Method: This column indicates the method of payment, whether it’s through direct deposit, check, or other means.

- Reference Number/Description: This column provides a unique identifier for each transaction and offers a concise description of the purpose.

- Balance: This column tracks the running balance of the payroll and disbursement account, reflecting the total inflow and outflow of money.

The Advantages of Maintaining a Payroll and Disbursement Journal:

Maintaining a thorough payroll and disbursement journal offers a multitude of benefits, significantly enhancing your financial management practices. Here’s a glimpse into its power:

- Accuracy and Transparency: The journal serves as a detailed record of all financial transactions, promoting accuracy in payroll calculations and ensuring transparency in all financial activities. Any discrepancies or errors can be easily identified and rectified.

- Improved Budgeting and Financial Planning: By tracking all income and expenses related to payroll and disbursements, you gain valuable insights into your company’s financial health. This empowers you to make informed budgetary decisions and develop effective financial plans.

- Auditing and Compliance: A well-maintained payroll and disbursement journal is an invaluable asset during audits. It provides auditors with clear documentation, ensuring compliance with tax regulations and labor laws.

- Enhanced Decision-Making: The journal provides accurate and comprehensive financial data, enabling you to make informed decisions regarding employee compensation, expense management, and overall financial strategies.

- Reduced Risk of Errors: The journal’s structured format minimizes the risk of errors and omissions in payroll calculations and disbursement processing.

- Streamlined Operations: The journal helps in organizing and streamlining payroll processes. This leads to increased efficiency and reduced administrative burden.

- Improved Employee Relationships: By ensuring accurate and timely payroll payments, you build trust and positive relationships with your employees.

- Historical Records: The journal acts as a comprehensive historical record of all payroll and disbursement transactions, providing valuable data for analysis and forecasting.

Image: www.viralcovert.com

Technology’s Role in Payroll Management:

While traditional journals are still widely used, the rise of technology has provided innovative solutions for payroll and disbursement management. Payroll software and online platforms offer automated processes, real-time updates, and enhanced security. These tools can significantly simplify the process, improve efficiency, and reduce manual errors.

Expert Tips for Effectively Utilizing Your Payroll and Disbursement Journal:

To reap the full benefits of a payroll and disbursement journal, consider these expert insights:

- Consistency is Key: Maintain consistent and accurate recording of all transactions. Avoid making assumptions or relying on memory—document every detail.

- Regular Reconciliation: Regularly reconcile your journal entries with your bank statements and other financial records. This helps pinpoint any inconsistencies early on and ensures accuracy.

- Dedicated Personnel: Assign a dedicated person or team to manage the journal and ensure its upkeep.

- Utilize Technology: Leverage payroll software and online platforms to streamline your processes and reduce manual errors.

Payroll And Disbursement Journal

Conclusion: Your Financial Compass

By embracing the power of a well-maintained payroll and disbursement journal, you empower your business with a robust financial foundation. It’s your guide to accurate record-keeping, insightful decision-making, and confident financial management. You’ll not only simplify operations but also gain a clearer picture of your company’s health, allowing you to navigate the ups and downs of your journey with greater clarity and control. Take the first step towards better financial management and unlock the true potential of your business by adopting this essential tool.