Have you ever dreamt of selling your investment property and using the profits to purchase a new one, all while minimizing your tax burden? The IRS offers a powerful tool for this scenario: the 1031 exchange. This strategy allows investors to defer capital gains taxes by reinvesting proceeds from the sale into a like-kind property. But how do you navigate this complex process and make sure you’re fulfilling all the requirements? That’s where understanding the 1031 exchange journal entry comes in.

Image: marindamermelstein.blogspot.com

Think of this entry as the financial roadmap guiding you through the intricacies of the 1031 exchange. It’s a meticulous record of every transaction, a crucial element for both tax compliance and financial clarity. This journal entry goes beyond a simple accounting ledger; it acts as a detailed narrative capturing the essence of your investment journey.

Understanding the Basics: 1031 Exchange and Its Significance

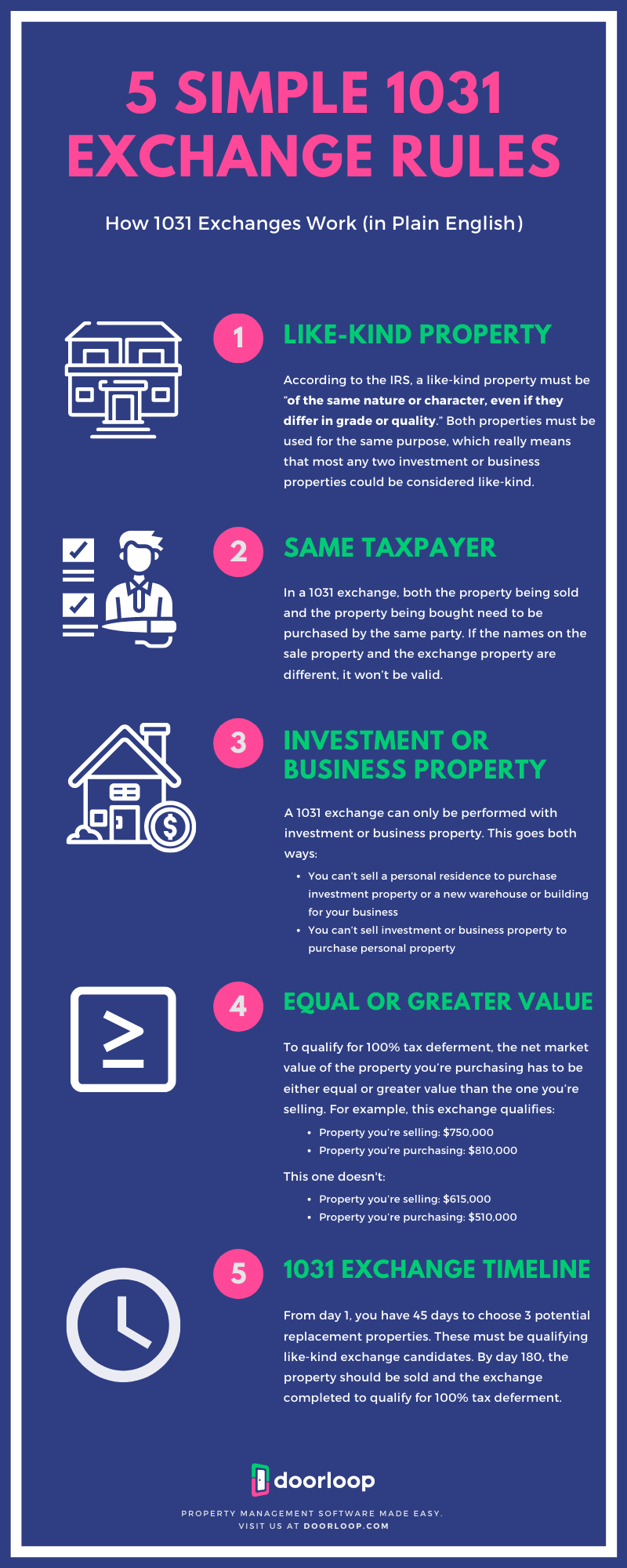

The 1031 exchange, officially known as a “like-kind exchange,” is a powerful tool in the real estate investor’s arsenal. It allows you to sell an investment property and reinvest the sale proceeds into another property of “like-kind” without triggering immediate capital gains taxes. This deferment provides valuable financial flexibility, allowing you to invest those funds into a new property with potentially greater profitability.

Unraveling the 1031 Exchange Journal Entry: A Comprehensive Breakdown

At the heart of the 1031 exchange process lies the journal entry, a detailed record of every financial transaction. Let’s break down the key components and their importance:

1. Property Identification: The journey starts with the detailed description of your relinquished property—the one you’re selling. This includes essential information like the address, legal description, and the purchase price.

2. Exchange Timeline: The journal entry documents the entire exchange timeline, from the initial sale date of your relinquished property to the final acquisition of your replacement property. This timeline must adhere to the strict IRS deadlines.

3. Acquisition and Dispositions: Every transaction related to both your relinquished and replacement property is documented meticulously. This includes details on the sale price, closing costs, financing, and any other expenses associated with the transaction.

4. Realized and Deferred Gains: A critical component of the journal entry is the calculation of realized gains, which represent the taxable portion of the profit from the sale of your relinquished property. The journal entry also details the amount of capital gains that are successfully deferred through the 1031 exchange.

5. Qualified Intermediary Involvement: The journal entry clearly outlines the role of the qualified intermediary in facilitating the exchange. This includes details on the intermediary’s fees and their involvement in handling all financial transactions between the seller, the buyer, and the replacement property.

6. Property Documentation: The journal entry includes copies of all relevant documentation related to the transaction. This can involve purchase agreements, closing statements, appraisal reports, and any other documentation needed to show the legitimacy of the exchange.

7. Tax Implications: It’s crucial to understand the tax implications of the 1031 exchange. While the exchange allows you to defer taxes, it doesn’t eliminate them entirely. The journal entry highlights the potential tax liabilities that may arise upon the future sale of the replacement property.

Expert Tips for Mastering the 1031 Exchange Journal Entry

1. Start Early: Don’t wait until the last minute to begin meticulously documenting your 1031 exchange. It’s a complex process with strict deadlines that require accurate recordkeeping.

2. Consult a Specialist: Seek professional guidance from a 1031 exchange specialist. They can provide expert advice and ensure complete compliance with IRS regulations.

3. Maintain Transparency: Preserve all documentation, including communication with the qualified intermediary, purchase agreements, and closing statements. This level of transparency demonstrates your commitment to tax compliance.

4. Seek Additional Advice: Engage with a licensed tax professional to review your 1031 exchange journal entry and help navigate its complex financial and legal aspects.

Image: casaplorer.com

1031 Exchange Journal Entry Example

The 1031 Exchange Journal Entry: A Powerful Tool for Real Estate Success

The 1031 exchange journal entry goes beyond mere documentation; it serves as a testament to your financial savvy and your commitment to real estate investment growth. By meticulously documenting every detail, you have a comprehensive record for tax purposes and a roadmap for navigating potential future tax liabilities.

Embrace the power of the 1031 exchange journal entry. By meticulously recording every financial transaction and seeking expert guidance, you can unlock the potential for tax-deferred growth and achieve long-term success in the real estate market.