Have you ever felt a twinge of anxiety as the stock market fluctuates wildly? We all have, to some degree. But with the right knowledge, you can navigate these turbulent waters with more confidence. This is where understanding the VIX and the VXX comes in. They might sound like secret codes for a hidden treasure, but they actually hold the key to unlocking the mysteries of volatility and how it influences your investments.

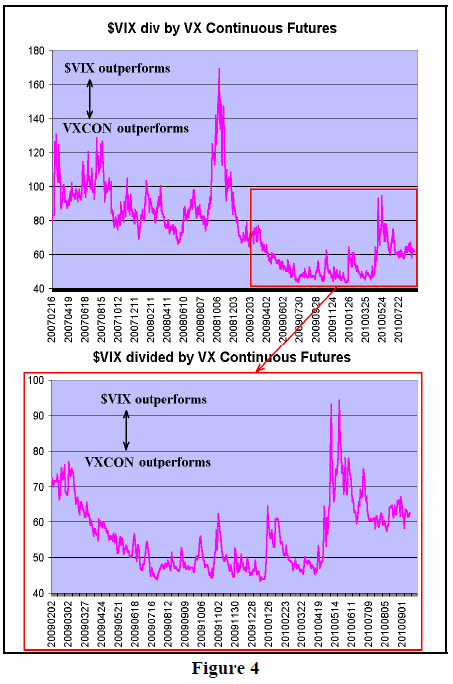

Image: www.optionstrategist.com

In this comprehensive guide, we will dive deep into the VIX and the VXX, unraveling their relationship and showcasing their potential impact on your portfolio. We’ll cover their history, explore their key differences, and unveil actionable strategies for utilizing these powerful tools in a responsible and insightful manner.

The VIX: A Gauge of Market Fear

The VIX, or the CBOE Volatility Index, is often referred to as the “fear gauge” of the market. It measures the expected volatility of the S&P 500 index over the next 30 days. The higher the VIX, the greater the expected volatility, which suggests investors are anticipating significant fluctuations in stock prices.

Imagine a calm sea with gentle waves. That’s a low VIX environment, where markets are relatively stable. Now, picture a tempestuous storm with raging waves crashing against the shore. That’s a high VIX environment, signaling a period of heightened market uncertainty and potential turbulence.

A Closer Look at the VIX Calculation

The VIX is calculated using a complex formula that takes into account the prices of a basket of S&P 500 index options. It is a forward-looking measure, meaning it reflects the current market sentiment and expectations about future volatility.

Here’s a simplified explanation:

- Options Prices: The VIX calculation utilizes the prices of S&P 500 index options with different strike prices and expiration dates. These options represent the right (but not the obligation) to buy or sell the underlying index at a predetermined price.

- Implied Volatility: By analyzing the prices of these options, the VIX derives an “implied volatility” figure, which essentially reflects the market’s expectation for the S&P 500’s price fluctuations over the next 30 days.

- Weighted Average: The VIX calculation involves weighting the implied volatilities of different options based on their strike prices and expiration dates to arrive at a single, comprehensive volatility measure.

Understanding VXX: Tracking the VIX’s Move

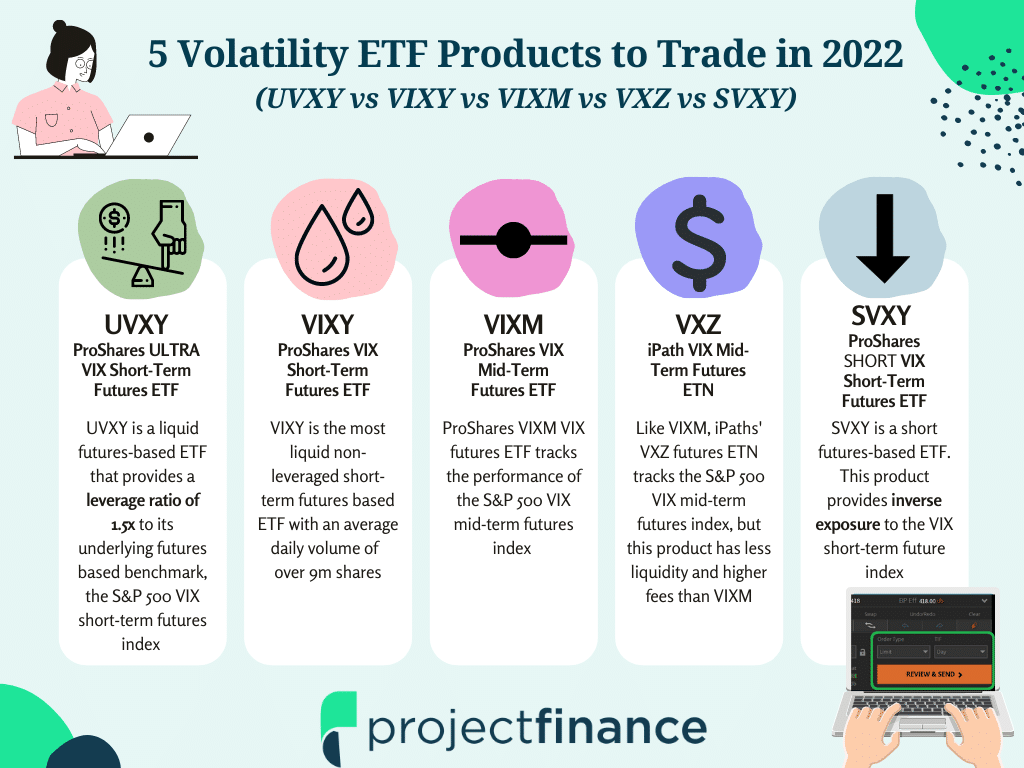

The VXX, or the iPath S&P 500 VIX Short-Term Futures ETN, is an exchange-traded note (ETN) that tracks the performance of the VIX short-term futures index. In essence, it allows investors to gain exposure to the volatility of the S&P 500 through a liquid and easily traded security.

When the VIX climbs, so does the price of the VXX. This makes the VXX a potential tool for investors who believe that volatility will increase in the market.

However, it’s important to remember that the VXX is not an investment for the faint of heart. Due to the nature of futures contracts, the VXX exhibits a tendency to decay over time, meaning its value gradually decreases even if the VIX remains flat.

Image: www.projectfinance.com

VXX vs VIX: Key Differences

The distinction between the VXX and the VIX lies in their nature and purpose:

- VIX: A benchmark index that measures expected volatility. It is a tool to gauge market sentiment and assess risk.

- VXX: A tradable security that tracks the performance of VIX short-term futures. It offers investors exposure to volatility but comes with inherent risks due to the nature of futures.

A Historical Perspective: VIX and VXX Through the Years

The VIX has played a crucial role in shaping the financial landscape, offering a valuable window into market sentiment. Notably, during periods of heightened uncertainty, the VIX has exhibited sharp spikes, reflecting investor anxiety and potential for significant price swings.

The VXX’s performance has largely mirrored the VIX’s trajectory, reflecting the inherent connection between the two. However, due to the decay factor inherent in futures contracts, the VXX has generally underperformed the VIX over longer periods.

Navigating the VXX for Informed Decisions

While the VXX offers potential opportunities, it’s crucial to approach it with caution and sound investment principles:

- Understand the Risks: The VXX is highly volatile, and its value can fluctuate significantly even over short periods.

- Short-Term Strategies: The VXX can be a useful tool for short-term trades, profiting from temporary spikes in market volatility.

- Long-Term Investments: It’s generally not recommended for long-term investments due to the inherent decay factor and risk of losing capital.

- Diversification: If you choose to invest in the VXX, it’s crucial to remember that it should be only a small part of a diversified portfolio.

Expert Insights on Volatility Management

Investing veterans caution against relying solely on the VIX or the VXX for investment decisions. Consider diversifying your portfolio across various asset classes and practicing sound risk management strategies. Here are some expert-backed insights:

- Focus on the Long Term: Instead of trying to time the market, focus on a long-term investment approach that aligns with your financial goals.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversify across different asset classes to mitigate risk and enhance portfolio stability.

- Develop a Financial Plan: A well-defined financial plan can help you establish clear goals and strategies, guiding your investment choices during both calm and volatile markets.

Vxx Vs Vix

Conclusion: Embracing Volatility with Knowledge

Understanding the VIX and the VXX is a crucial step in becoming a more informed and astute investor. By demystifying these concepts, you can navigate the complexities of market volatility with greater confidence. Remember, knowledge is power, and with the right understanding, you can harness the potential of volatility to build a resilient and robust portfolio.

Don’t hesitate to further explore the world of volatility management. Utilize the wealth of resources available online, consult with financial advisors, and continue to expand your knowledge to make informed investment decisions.