Traveling to Japan? Planning a purchase from a Japanese online store? Or maybe you’re just curious about the value of the Japanese yen against the US dollar? Regardless of the reason, understanding the current exchange rate between 60,000 yen and USD is essential for making informed decisions. As a frequent traveler to Japan, I’ve firsthand experienced the importance of staying updated on the exchange rates, especially when it comes to budgeting for travel expenses.

Image: bright52.medium.com

Knowing the current exchange rate helps you make better financial choices, whether it’s getting the most out of your travel money or comparing prices across different stores and currencies. This article will delve into the conversion of 60,000 yen to USD, providing insights into the dynamic relationship between these currencies and exploring the impact on your finances.

The Current Exchange Rate: 60,000 Yen to USD

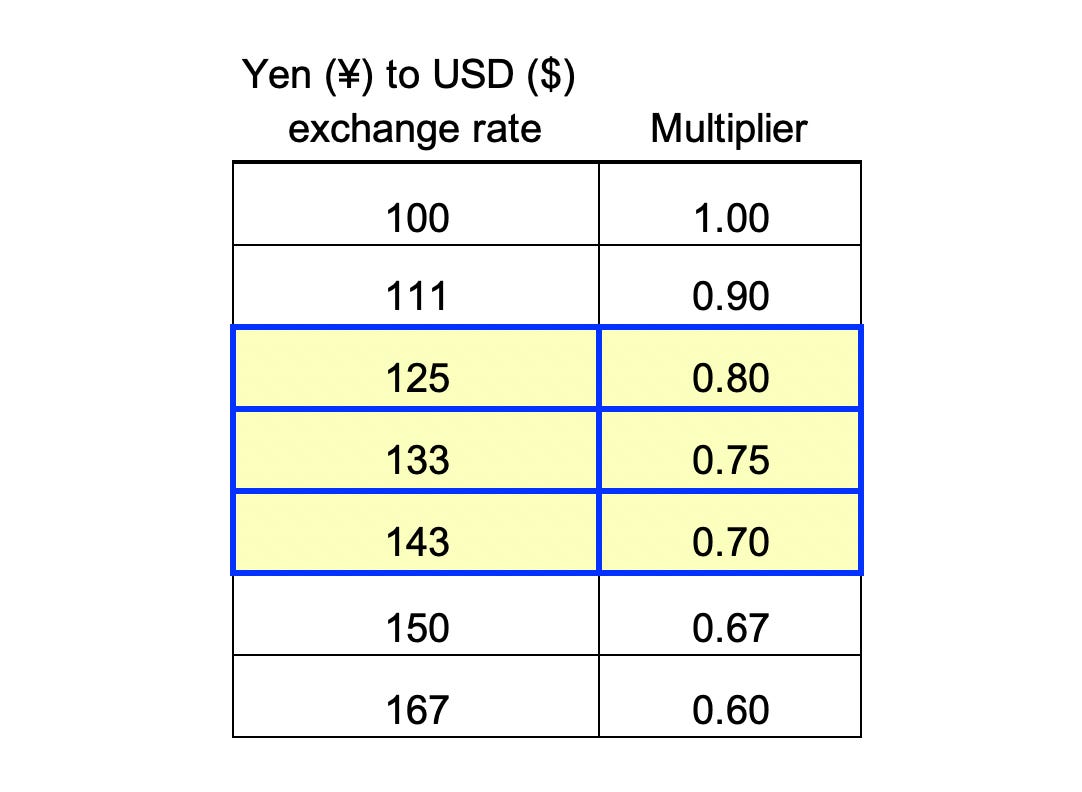

The exchange rate between the Japanese yen (JPY) and US dollar (USD) is constantly fluctuating due to various economic factors. To get the most accurate and up-to-date conversion, it’s recommended to use a reputable online currency converter or check with your bank. However, here are some points to consider:

- Real-time fluctuations: The exchange rate changes throughout the day, minute by minute. Therefore, the conversion of 60,000 yen to USD will vary based on the time of the transaction.

- Exchange fees: Financial institutions charge fees when exchanging currencies. These fees can vary depending on the provider, so it’s essential to compare rates to minimize costs.

- Mid-market rate: This is the average exchange rate without any fees or markups. While you won’t get the exact mid-market rate, it serves as a good reference point. You can find the mid-market rate on currency converter websites.

Factors Influencing the Yen to USD Exchange Rate

Understanding the factors affecting the yen to USD exchange rate enables you to make more informed financial decisions. Here are some key factors at play:

- Economic growth: Strong economic performance in Japan typically leads to a stronger yen, while economic weakness pushes the yen down.

- Interest rates: Higher interest rates in Japan might attract foreign investment, boosting demand for the yen and strengthening its value against the US dollar. Conversely, lower interest rates might weaken the yen.

- Government policies: Intervention in the foreign exchange market by the Bank of Japan can impact the yen’s value.

- Global risk sentiment: During periods of global uncertainty or heightened risk, investors may seek safe-haven currencies like the yen, leading to its appreciation.

- Trade activity: Japan’s trade balance, especially exports and imports, can influence the yen’s value against the USD. A trade surplus might strengthen the yen, while a deficit may weaken it.

- Inflation: Higher inflation in Japan, compared to the United States, can weaken the yen against the USD.

Staying Informed on Exchange Rates

Tracking the exchange rate between 60,000 yen and USD is crucial, especially for those planning to travel or make international transactions. There are several resources to help you:

- Online currency converters: Websites like Google Finance, XE.com, and other currency converter services provide real-time exchange rates.

- Financial news websites: Stay updated on news regarding the Japanese economy and global economic trends, as these can significantly impact exchange rates.

- Mobile banking apps: Most banks offer mobile apps that provide access to real-time exchange rates and currency conversion tools.

Image: www.exchangerates.org.uk

Tips for Managing Currency Fluctuations

Currency fluctuations can be unpredictable. Here are some practical tips to help manage these fluctuations:

- Convert currency in advance: Consider converting your USD to JPY before traveling to Japan to avoid potential losses due to fluctuations. However, avoid exchanging large amounts at once to mitigate against further fluctuations.

- Use a debit or credit card: Paying with a debit or credit card linked to your USD account often offers better rates than exchanging cash at local exchange bureaus.

- Utilize ATMs: Withdraw local currency from ATMs using your debit card; this is often a cost-effective option, especially if your bank has an international network.

- Avoid exchanging currency at airports or hotels: Exchange bureaus at these locations often have higher fees and less favorable exchange rates.

Expert Advice

Here are some tips from experienced travelers for managing foreign currency conversions:

- Track exchange rates regularly: Stay informed about trends and fluctuations to make the most optimal decisions, especially when converting larger sums.

- Consider using a travel credit card with good rewards: Many credit cards offer travel rewards, such as miles or points, which can offset expenses and provide further savings.

- Research and compare exchange rates: Don’t settle for the first exchange rate you see. Compare rates from different providers to ensure you get the best deal.

FAQ

Here are some frequently asked questions about converting 60,000 yen to USD:

Q: How much is 60,000 yen in USD?

A: The exact conversion of 60,000 yen to USD will vary depending on the current exchange rate. To get an accurate figure, use a reputable online currency converter or consult with your bank.

Q: What is the best time to exchange yen to USD?

A: There’s no guaranteed best time, as exchange rates fluctuate constantly. However, keeping an eye on economic news in both Japan and the United States can help you make informed decisions.

Q: How can I avoid exchanging currency at unfavorable rates?

A: Comparing rates from different providers, utilizing ATMs for withdrawals, and considering debit/credit card payments can help minimize exchange fees. Avoid exchanging currency at airports or hotels as they tend to have higher fees.

60 000 Yen To Usd

Conclusion

Understanding the value of the Japanese yen against the US dollar is crucial for making informed decisions, especially when traveling to Japan or dealing with international transactions. Remember to keep an eye on the constantly changing exchange rate, utilize reliable currency converters, and leverage the tips provided to manage currency fluctuations effectively.

Are you interested in learning more about the various financial considerations when traveling to Japan or making international payments? Let’s continue the conversation in the comments!