Imagine you’re a retiree, enjoying your hard-earned golden years. You’ve meticulously planned for your future, investing in a diversified portfolio. But what if the market takes a sudden downturn, putting your retirement savings at risk? This is where indexed annuities come in, offering a unique approach to protect your principal while still allowing for potential growth.

Image: www.1stfinancialwm.com

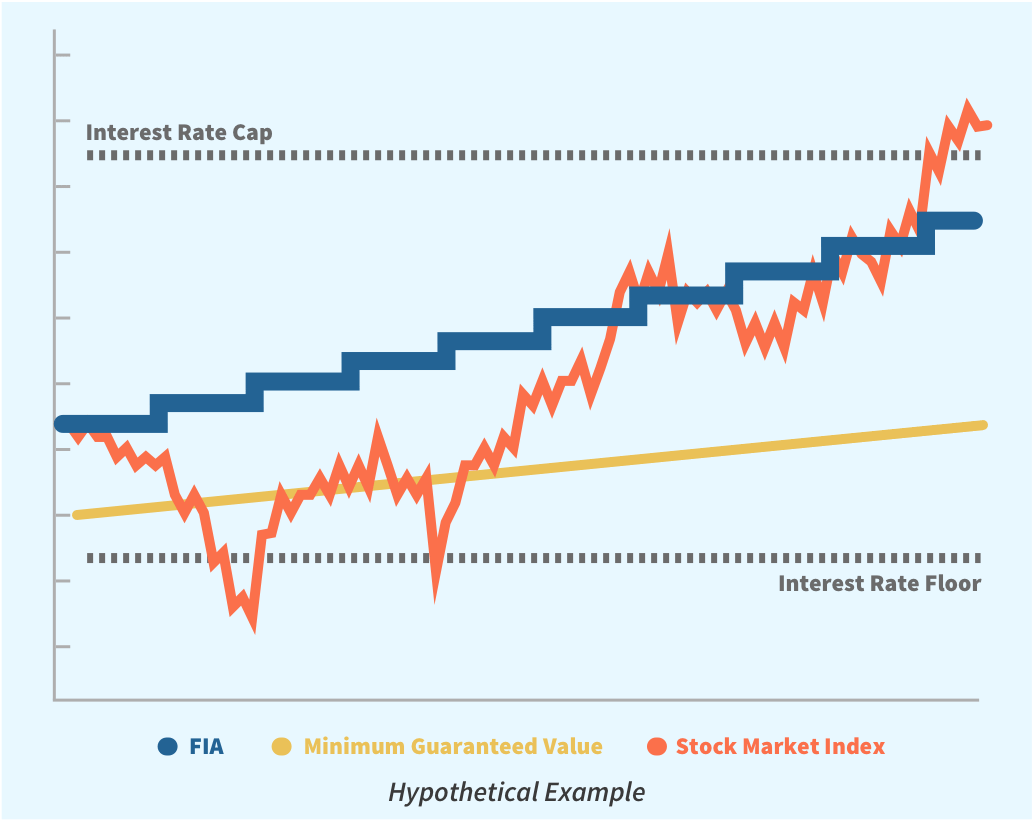

A key feature of indexed annuities is the “specified floor.” Understanding this concept can make a world of difference when navigating the financial landscape of retirement. But how does the specified floor work, and what does it truly mean for your investments? Let’s dive deeper into the fascinating world of indexed annuities and uncover the secrets of the specified floor.

Understanding the Basics of Indexed Annuities

Indexed annuities are investment vehicles that offer both potential upside gains linked to a specific market index like the S&P 500 and downside protection. You choose an index, and the annuity’s value rises or falls based on that index’s performance, but with a built-in safety net. This safety net is the “specified floor,” ensuring your principal is safeguarded from significant market losses. The specified floor acts as a minimum value for your investment.

Think of it like a sturdy safety net beneath a trapeze artist. Even if the artist stumbles or the market dips, the safety net guarantees a minimum level of security. The specified floor adds a dimension of peace of mind, knowing that even in turbulent market conditions, your principal is protected.

The Power of the Specified Floor

The specified floor is a significant aspect of indexed annuities. Unlike traditional annuities that lock in a fixed interest rate, indexed annuities offer the potential for growth tied to the stock market. However, this comes with the inherent risk of market volatility.

Here’s where the specified floor steps in. You have a minimum guaranteed rate of return, often called the “crediting rate.” This crediting rate can be a fixed percentage or a “floor” that prevents your investment from depreciating below a certain point. It’s like having a solid foundation for your investment, ensuring that your gains are never completely erased by market downturns.

The specified floor can be expressed as a percentage of your initial investment. For example, a 0% floor means your principal will never go down. A 5% floor guarantees that even if the market declines, your investment won’t go below 95% of the original value. This safety net can offer valuable peace of mind, especially for individuals nearing or already in retirement.

Types of Specified Floors

Depending on the insurance company and the specific annuity, the specified floor can vary. Common types of floors include:

- Zero floor: This offers the highest level of protection, ensuring your principal never depreciates below the initial investment value.

- Fixed percentage floor: This provides a fixed percentage of your initial investment as a floor, e.g., a 5% floor. Your investment won’t dip below 95% of the original amount.

- Floating floor: This floor is tied to a benchmark such as the current interest rate. The floor adjusts along with the benchmark, providing some flexibility.

It’s crucial to compare different annuity options to find one that offers a floor that aligns with your risk tolerance and investment goals. The higher the floor, the greater the protection your investment receives, but it may come with lower potential growth.

Image: www.aiohotzgirl.com

Understanding the Participation Rate

Another key element tied to the specified floor is the “participation rate.” This rate determines how much of the index’s gains you receive. If the participation rate is 80%, you’ll get 80% of the index’s growth, while the remaining 20% is retained by the insurance company as a fee. A higher participation rate will amplify your potential gains but may also come with higher fees.

The participation rate and the specified floor often work in tandem. The higher the specified floor, the lower the participation rate might be. This makes sense because a higher floor provides more security, and the insurance company may need to adjust the participation rate to balance that extra protection.

Capital Gains and Taxes

One question that often arises is how capital gains from your indexed annuity are taxed. The answer depends on whether you’ve withdrawn the gains or not. If you withdraw the gains, they’ll be treated as ordinary income and taxed at your usual tax bracket.

However, if the gains stay within the annuity, they won’t be taxed until withdrawal. This “tax deferral” can be a valuable advantage when it comes to maximizing your long-term investment returns. It’s crucial to consult with a qualified tax advisor to determine the appropriate approach for your specific situation.

Key Considerations Before Investing in an Indexed Annuity

Before diving into an indexed annuity, it’s vital to consider factors beyond the specified floor, including:

- Fees: Indexed annuities typically have higher fees compared to traditional annuities. It’s essential to compare these fees across different options and ensure they align with your budget.

- Charges: Be aware of any surrender charges that may apply if you withdraw your funds before the surrender period. Understand the consequences of early withdrawal.

- Market Performance: The specified floor provides protection from market downturns, but it doesn’t guarantee market gains. It’s crucial to understand that the value of an indexed annuity can still fluctuate.

- Insurance Company Stability: Choose a financially stable and reputable insurance company to ensure the security of your investment.

- Your Investment Goals: Indexed annuities are suitable for individuals seeking a balance of growth and principal protection. They may not be ideal if you’re aiming for aggressive growth.

Expert Advice and Actionable Tips for Indexed Annuities

The decision to invest in an indexed annuity should be based on careful consideration of your unique financial circumstances, investment goals, and risk tolerance. Here are some tips to guide your journey:

- Consult with a qualified financial advisor:

- Compare different options:

- Read the fine print:

- Reassess your investment portfolio:

A financial advisor can help you understand the complexities of indexed annuities. They’ll guide you through the process of selecting the right annuity, ensuring it aligns with your investment goals and risk profile.

Don’t settle for the first option you encounter. Compare various annuities from different insurance companies, considering factors like the specified floor, participation rate, fees, surrender charges, and the insurer’s financial strength.

Carefully review the contract before signing up. Understand the terms and conditions, ensuring they meet your expectations.

Your financial needs and investment goals may change over time. Regularly review your portfolio, and consider adjusting your strategy as needed.

For Most Indexed Annuities What Is The Specified Floor

https://youtube.com/watch?v=hUEqX6z-FYo

Conclusion

The specified floor in an indexed annuity serves as a safety net, protecting your principal from significant market downturns. Understanding this aspect of indexed annuities is crucial for making informed investment decisions. Remember, while the specified floor provides protection, it doesn’t guarantee market gains. Before investing, do your homework, consult with a financial advisor, and choose an annuity that aligns with your risk tolerance and investment goals. With proper understanding and careful planning, indexed annuities can be a valuable tool as you navigate the ever-changing financial landscape.